ANNUAL REPORT

2019

| Millions of pesos | 2019 1 | 2019 2 | 2018 8 | %Change | 2017 9 | %Change |

|---|---|---|---|---|---|---|

| Total revenues | 26,867 | 506,711 | 469,744 | 7.9% | 439,932 | 6.8% |

| Income from operations 3 | 2,500 | 47,152 | 41,576 | 13.4% | 40,261 | 3.3% |

| Operating margin | 9.3% | 8.9% | 9.2% | |||

| Consolidated net income | 1,487 | 28,048 | 33,079 | -15.2% | 37,206 | -11.1% |

| Controlling interest net income 4 | 1,098 | 20,699 | 23,990 | -13.7% | 42,408 | -43.4% |

| Controlling interest earnings per BD unit 5 | 0.3 | 5.8 | 6.7 | -13.4% | 11.9 | -43.7% |

| Controlling interest earnings per ADS 6 | 3.1 | 57.8 | 67.0 | -13.7% | 118.5 | -43.5% |

| EBITDA | 4,000 | 75,440 | 60,458 | 24.8% | 58,165 | 3.9% |

| EBITDA margin | 14.9% | 12.9% | 13.2% | |||

| Total assets | 33,804 | 637,541 | 576,381 | 10.6% | 588,541 | -2.1% |

| Total liabilities | 16,532 | 311,790 | 240,839 | 29.5% | 251,629 | -4.3% |

| Total equity | 17,272 | 325,751 | 335,542 | -2.9% | 336,912 | -0.4% |

| Capital expenditures | 1,356 | 25,579 | 24,266 | 5.4% | 23,486 | 3.3% |

| Total cash and cash equivalents 7 | 3,476 | 65,562 | 62,047 | 5.7% | 96,944 | -36.0% |

| Short-term debt | 859 | 16,204 | 13,674 | 18.5% | 13,590 | 0.6% |

| Long-term debt | 5,395 | 101,747 | 114,990 | -11.5% | 117,758 | -2.4% |

| Headcount 8 | 314,656 | 297,073 | 5.9% | 295,027 | 0.7% |

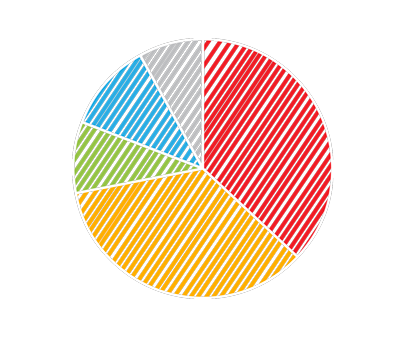

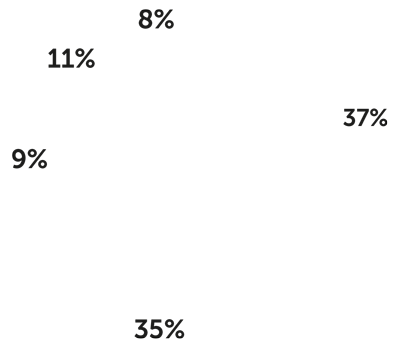

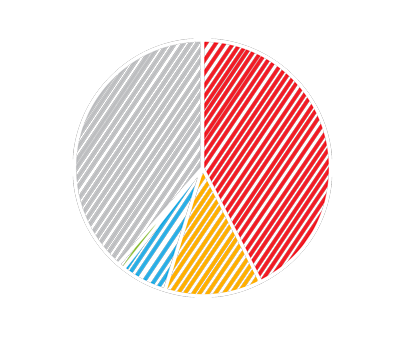

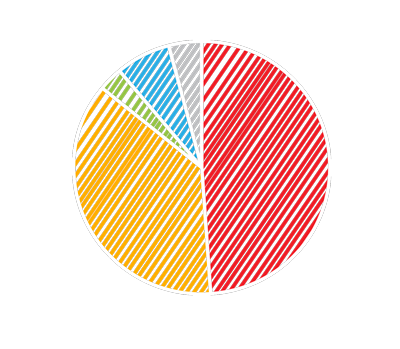

Total Revenues

by Business Unit

millions of Mexican pesos

Ps. 506,711

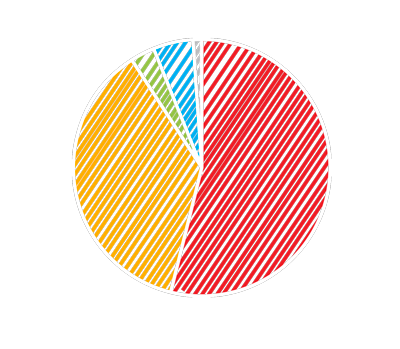

Total Assets

by Business Unit

millions of Mexican pesos

Ps. 637,541

Income from Operations 1

by Business Unit

millions of Mexican pesos

Ps. 47,152

EBITDA 2

by Business Unit

millions of Mexican pesos

Ps. 75,440

Coca-Cola FEMSA

FEMSA Comercio: Proximity Division Health Division Fuel Division Others*

* Includes FEMSA Strategic Businesses.

1. Company’s key performance indicator.

2. EBITDA equals to Income from operations plus depreciation, amortization and other non-cash items