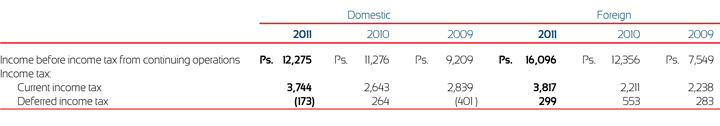

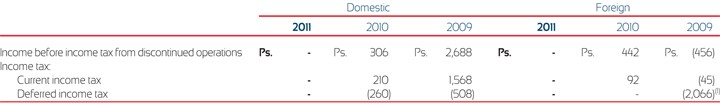

For the years ended December 31, 2011, 2010 and 2009. Amounts expressed in millions of U.S. dollars ($) and in millions of Mexican pesos (Ps.).

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 |

23 Taxes

a) Income Tax:

Income tax is computed on taxable income, which differs from net income for accounting purposes principally due to the treatment of the inflationary effects, the cost of labor liabilities for employee benefits, depreciation and other accounting provisions. A tax loss may be carried forward and applied against future taxable income.

Domestic income before income tax from continuing operations is presented net of dividends received from foreign entities. The income tax paid in foreign countries is compensated with the consolidated income tax paid in Mexico for the period.

(1) Application of tax loss carryforwards due to Brazil amnesty adoption.

The statutory income tax rates applicable in the countries where the Company operates, the years in which tax loss carryforwards may be applied and the open periods that remain subject to examination as of December 31, 2011 are as follows:

The statutory income tax rate in Mexico was 30% for 2011 and 2010, and 28% for 2009.

In Panama, the statutory income tax rate for 2011, 2010 and 2009 was 25%, 27.5% and 30%, respectively.

On January 1, 2010, the Mexican Tax Reform was effective. The most important changes related to Mexican Tax Reform 2010 are described as follows: the value added tax rate (IVA) increases from 15% to 16%, an increase in special tax on productions and services from 25% to 26.5%; and the statutory income tax rate changes from 28% in 2009 to 30% for 2010, 2011 and 2012, and then in 2013 and 2014 will decrease to 29% and 28%, respectively. Additionally, the Mexican tax reform requires that income tax payments related to consolidation tax benefits obtained since 1999, have to be paid during the next five years beginning on the sixth year when tax benefits were used (see Note 23 C).

In Colombia, tax losses may be carried forward for an indefinite period and they are limited to 25% of the taxable income of each year.

In Brazil, tax losses may be carried forward for an indefinite period but cannot be restated and are limited to 30% of the taxable income of each year.

During 2009 and 2010, Brazil adopted new laws providing for certain tax amnesties. The tax amnesty programs offers Brazilian legal entities and individuals an opportunity to pay off their income tax and indirect tax debts under less stringent conditions than would normally apply. The amnesty programs also include a favorable option under which taxpayers may utilize income tax loss carry-forwards ("NOLs") when settling certain outstanding income tax and indirect tax debts. The Brazilian subsidiary of Coca-Cola FEMSA decided to participate in the amnesty programs allowing it to settle certain previously accrued indirect tax contingencies. During the years ended, December 31, 2010 and 2009 the Company de-recognized indirect tax contingency accruals of Ps. 333 and Ps. 433 respectively (see Note 24 C), making payments of Ps. 118 and Ps. 243, recording a credit to other expenses of Ps. 179 and Ps. 311 (see Note 18), reversing previously recorded Brazil valuation allowances against NOL's in 2009, and recording certain taxes recoverable. During 2011, there were no tax amnesty programs applied by the Company.

Tax on Assets:

The operations in Guatemala, Nicaragua, Colombia and Argentina are subject to a minumum tax, which is based primary on a percentage of assets. Any payments are recoverable in future years, under certain conditions. In Mexico, the Company has recoverable tax on assets generated in years earlier than 2008, which is recognized as recoverable taxes and can be recovered through tax returns (see Note 23 E).

b) Business Flat Tax ("IETU"):

Effective in 2008, the IETU came into effect in Mexico and replaced the Tax on Assets. IETU functions are similar to an alternative minimum corporate income tax, except that amounts paid cannot be creditable against future income tax payments. The payable tax will be the higher between the IETU or the income tax liability computed under the Mexican income tax law. The IETU applies to corporations, including permanent establishments of foreign entities in Mexico, at a rate of 17.5% beginning in 2010. The rate for 2009 was 17.0%. The IETU is calculated under a cash-flows basis, whereby the tax base is determined by reducing cash proceeds with certain deductions and credits. In the case of income derived from export sales, where cash on the receivable has not been collected within 12 months, income is deemed received at the end of this 12-month period. In addition, as opposed to Mexican income tax which allows for fiscal consolidation, companies that incur IETU are required to file their returns on an individual basis.

The Company has paid corporate income tax since IETU came into effect, and based on its financial projections for purposes of its Mexican tax returns, the Company expects to continue to pay corporate income tax in the future and does not expect to pay IETU. As such, the enactment of IETU has not affected the Company's consolidated financial position or results of operations.

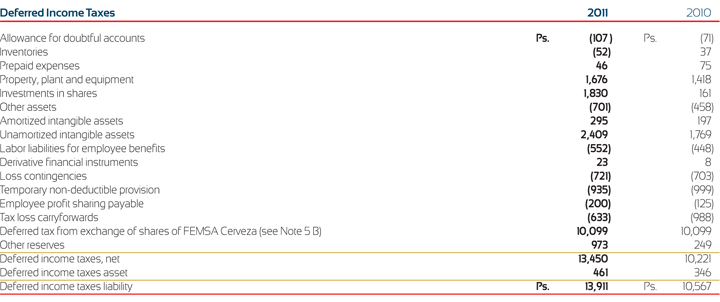

c) Deferred Income Tax:

Effective January 2008, in accordance with NIF B-10, "Effects of Inflation," in Mexico the application of inflationary accounting is suspended. However, for taxes purposes, the balance of non monetary assets is restated through the application of National Consumer Price Index (NCPI) of each country. For this reason, the difference between accounting and taxable values will increase, generating a deferred tax.

The impact to deferred income tax generated by liabilities (assets) temporary differences are as follows:

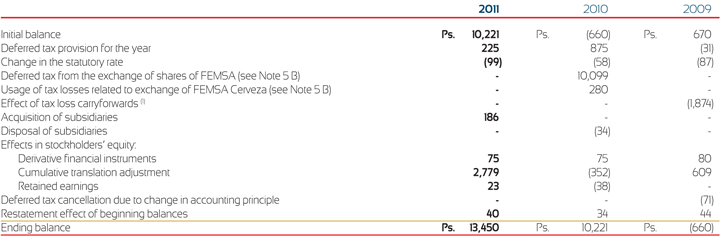

The changes in the balance of the net deferred income tax liability are as follows:

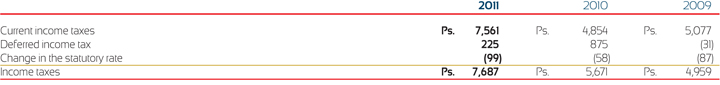

(1) Effect due to 2010 Mexican tax reform, which deferred taxes were reclassified to other current liabilities and other liabilities according to its maturity. d) Provision for the Year:

e) Tax Loss Carryforwards and Recoverable Tax on Assets:

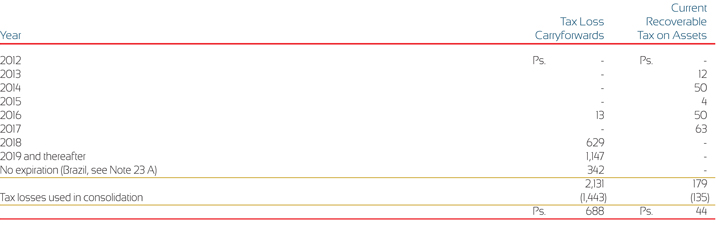

The subsidiaries in Mexico and Brazil have tax loss carryforwards and/or recoverable tax on assets. The taxes effect net of consolidation benefits and their years of expiration are as follows:

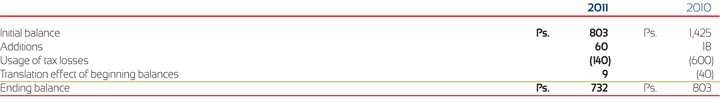

The changes in the balance of tax loss carryforwards and recoverable tax on assets, excluding discontinued operations are as follows:

As of December 31, 2011 and 2010, there is no valuation allowance recorded due to the uncertainty related to the realization of certain tax loss carryforwards and tax on assets.

f) Reconciliation of Mexican Statutory Income Tax Rate to Consolidated Effective Income Tax Rate: