For the years ended December 31, 2011, 2010 and 2009. Amounts expressed in millions of U.S. dollars ($) and in millions of Mexican pesos (Ps.).

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 |

5 Acquisitions and Disposals

a) Acquisitions:

Coca-Cola FEMSA made certain business acquisitions that were recorded using the purchase method. The results of the acquired operations have been included in the consolidated financial statements since Coca-Cola FEMSA obtained control of acquired businesses as disclosed below. Therefore, the consolidated income statements and the consolidated balance sheets in the years of such acquisitions are not comparable with previous periods. The consolidated cash flows for the years ended December 31, 2011 and 2009 show the acquired operations net of the cash related to those acquisitions. In 2010 the Company did not have any significant business combinations.

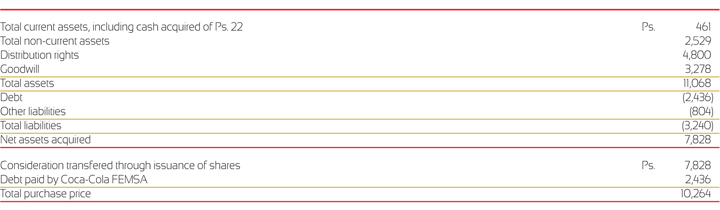

i) On October 10, 2011, Coca-Cola FEMSA completed the acquisition of 100% of Administradora de Acciones del Noreste, S.A. de C.V. ("Grupo Tampico") a bottler of Coca-Cola trademark products in the states of Tamaulipas, San Luis Potosí and Veracruz; as well as in parts of the states of Hidalgo, Puebla and Queretaro. This acquisition was made so as to reinforce the Coca-Cola FEMSA's leadership position in Mexico and Latin America. The transaction involved: (i) the issuance of 63,500,000 shares of previously unissued Coca-Cola FEMSA L shares, and (ii) the assumption of previous intercompany debt of Ps. 2,436, in exchange for 100% share ownership of Grupo Tampico, which was accomplished through a merger. The total purchase price was Ps. 10,264 based on a share price of 123.27 per share on October 10, 2011. Transaction related costs of Ps. 20 were expensed by the Coca-Cola FEMSA as incurred as required by Mexican FRS, and recorded as a component of administrative expenses in the accompanying consolidated statements of income. Grupo Tampico was included in operating results from October, 2011.

The Coca-Cola FEMSA's preliminary estimate of fair value of the Grupo Tampico's net assets acquired is as follows:

Coca-Cola FEMSA's purchase price allocation is preliminary in nature in that its estimation of the fair value of distribution rights is pending receipt of final valuation reports by a third-party valuation experts. To date, only draft reports have been received.

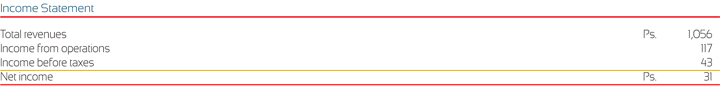

The condensed income statement of Grupo Tampico for the period from October 10 to December 31, 2011 is as follows:

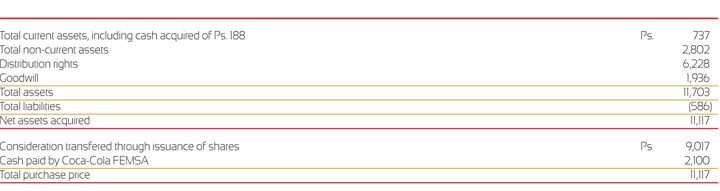

ii) On December 9, 2011, Coca-Cola FEMSA completed the acquisition of 100% of Corporación de los Angeles, S.A. de C.V. ("Grupo CIMSA"), a bottler of Coca-Cola trademark products, which operates mainly in the states of Morelos and Mexico, as well as in parts of the states of Guerrero and Michoacan, Mexico. This acquisition was also made so as to reinforce the Coca-Cola FEMSA's leadership position in Mexico and Latin America. The transaction involved the issuance of 75,423,728 shares of previously unissued Coca-Cola FEMSA L shares along with the cash payment prior to closing of Ps. 2,100 in exchange for 100% share ownership of Grupo CIMSA, which was accomplished through a merger. The total purchase price was Ps. 11,117 based on a share price of Ps. 119.55 per share on December 9, 2011. Transaction related costs of Ps. 24 were expensed by the Coca-Cola FEMSA as incurred as required by Mexican FRS, and recorded as a component of administrative expenses in the accompanying consolidated statements of income. Grupo CIMSA was included in operating results from December 2011.

Coca-Cola FEMSA, preliminary estimate of fair value of Grupo CIMSA's net assets acquired is as follows:

Coca-Cola FEMSA's purchase price allocation is preliminary in nature in that its estimation of the fair value of property and equipment and distribution rights is pending receipt of final valuation reports by a third-party valuation experts. To date, only draft reports have been received.

The condensed income statement of Grupo CIMSA for the period from December 12, to December 31, 2011 is as follows:

iii) On February 27, 2009, Coca-Cola FEMSA, along with The Coca-Cola Company, completed the acquisition of certain assets of the Brisa bottled water business in Colombia. This acquisition was made so as to strengthen Coca-Cola FEMSA's position in the local water business in Colombia. The Brisa bottled water business was previously owned by a subsidiary of SABMiller. Terms of the transaction called for an initial purchase price of $92, of which $46 was paid by Coca-Cola FEMSA and $46 by The Coca-Cola Company. The Brisa brand and certain other intangible assets were acquired by The Coca-Cola Company, while production related property and equipment and inventory was acquired by Coca-Cola FEMSA. Coca-Cola FEMSA also acquired the distribution rights over Brisa products in its Colombian territory. In addition to the initial purchase price, contingent purchase consideration also existed related to the net revenues of the Brisa bottled water business subsequent to the acquisition. The total purchase price incurred by Coca-Cola FEMSA was Ps. 730, consisting of Ps. 717 in cash payments, and accrued liabilities of Ps. 13. Transaction related costs were expensed by Coca-Cola FEMSA as incurred, as required by Mexican FRS. Following a transition period, Brisa was included in Coca-Cola FEMSA's operating results beginning June 1, 2009.

The estimated fair value of Brisa's net assets acquired by Coca-Cola FEMSA is as follows:

Brisa's results operation for the period from the acquisition through December 31, 2009 were not material to our consolidated results of operations.

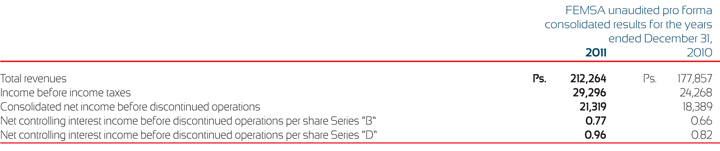

iv) Unaudited Pro Forma Financial Data.

The following unaudited consolidated pro forma financial data represent the Company's historical financial statements, adjusted to give effect to (i) the acquisitions of Grupo Tampico and Grupo CIMSA mentioned in the preceding paragraphs; and (ii) certain accounting adjustments mainly related to the pro forma depreciation of fixed assets of the acquired companies.

The unaudited pro forma adjustments assume that the acquisitions were made at the beginning of the year immediately preceding the year of acquisition, and are based upon available information and other assumptions that management considers reasonable. The pro forma financial information data does not purport to represent what the effect on the Company's consolidated operations would have been for each year, had the transactions in fact occurred on January 1, 2010, nor are they intended to predict the Company's future results of operations.

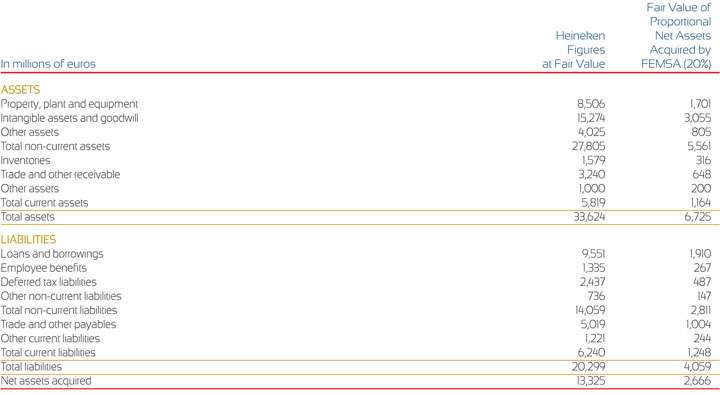

i) On April 30, 2010 FEMSA exchanged 100% of FEMSA Cerveza, the beer business unit, for 20% economic interest in Heineken. Under the terms of the agreement, FEMSA exchanged its beer business and received 43,018,320 shares of Heineken Holding N.V., and 72,182,203 shares of Heineken N.V., of which 29,172,504 will be delivered pursuant to an allotted share delivery instrument ("ASDI"). Those shares are considered in substance common stock due to its similarity to common stock, such as rights to receive the same dividends as any other share. Under the ASDI, it was expected that the allotted shares would be acquired by Heineken in the secondary market for delivery to FEMSA over a term not to exceed five years. As of December 31, 2011, the process of delivery of all shares has been completed (and 10,240,553 shares had been delivered to the Company as of December 31, 2010) (see Note 9).

The total transaction was valued approximately at $7,347, net of assumed debt of $2,100, based on shares closing prices of € 35.18 for Heineken N.V., and € 30.82 for Heineken Holding N.V. on April 30, 2010. The Company recorded a net gain after taxes that amounted to Ps. 26,623 which is the difference between the fair value of the consideration received and the book value of FEMSA Cerveza as of April 30, 2010; a deferred income tax of Ps. 10,379 (see "Income from the exchange of shares with Heineken, net of taxes" in the consolidated income statements and Note 23 C), and recycling Ps. 525 (see consolidated statements of changes in stockholders' equity) from other comprehensive income which are integrated of Ps.1,418 accounted as a gain of cumulative translation adjustment and Ps. 893 as a mark to market loss on derivatives in cumulative comprehensive loss. Additionally, the Company maintained a loss contingency of Ps. 560 as of December 31, 2010, regarding the indemnification accorded with Heineken over FEMSA Cerveza prior tax contingencies. This contingency amounted to Ps. 445 as of December 31, 2011 and Ps. 113 has been reclassified to other current liabilities (see Note 24 B).

As of the date of the exchange, the Company lost control over FEMSA Cerveza and stopped consolidating its financial information and accounted for the 20% economic interest of Heineken acquired by the purchase method as established in NIF C-7 "Investments in Associates and Other Permanent Investments." Subsequently, this investment in shares has been accounted for by the equity method, because of the Company's significant influence.

After purchase price adjustments, the Company identified intangible assets of indefinite and finite life brands and goodwill that amounted to € 14,074 million and € 1,200 million respectively and increased certain operating assets and liabilities to fair value, which are presented as part of the investment in shares of Heineken within the consolidated financial statement.

The fair values of the proportional assets acquired and liabilities assumed as part of this transaction are as follows:

Summarized consolidated balance sheet and income statements of FEMSA Cerveza are presented as follows as of:

As a result of the transaction described above, FEMSA Cerveza operations for the period ended on April 30, 2010, and December 31, 2009 are presented in a single line as discontinued operations, net of taxes in the consolidated income statement. Prior years consolidated financial statements and the accompanying notes were reformulated in order to present FEMSA Cerveza as discontinued operations for comparable purposes.

Consolidated statement of cash flows of December 31, 2010 and 2009 presents FEMSA Cerveza as discontinued operations. Intercompany transactions between the Company and FEMSA Cerveza for 2009 were reclassified in order to conform to consolidated financial statements as of December 31, 2010.

ii) On September 23, 2010, the Company disposed of its subsidiary Promotora de Marcas Nacionales, S.A. de C.V. for which it received a payment of Ps.1,002 from The Coca-Cola Company. The Company recognized a gain of Ps. 845 as a sale of shares within other expenses, which is the difference between the fair value of the consideration received and the carrying value of the net assets disposed.

iii) On December 31, 2010, the Company disposed of its subsidiary Grafo Regia, S.A. de C.V for which it received a payment of Ps. 1,021. The Company recognized a gain of Ps. 665, as a sale of shares within other expenses, which is the difference between the fair value of the consideration received and the carrying value of the net assets disposed.