For the years ended December 31, 2011, 2010 and 2009. Amounts expressed in millions of U.S. dollars ($) and in millions of Mexican pesos (Ps.).

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 |

24 Other Liabilities, Contingencies and Commitments

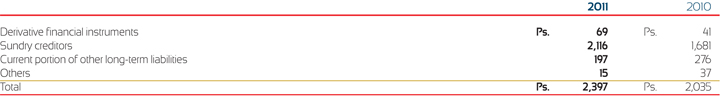

a) Other Current Liabilities:

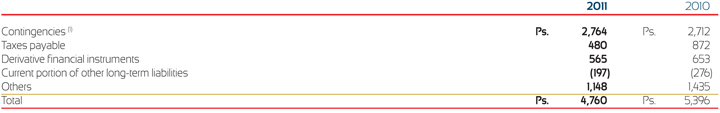

b) Contingencies and Other Liabilities:

(1) As of December 31, 2010 included Ps. 560 of tax loss contingencies regarding indemnification accorded with Heineken over FEMSA Cerveza, prior tax contingencies, of which Ps. 113 were recognized as other current liabilities and Ps. 2 were cancelled as of December 31, 2011.

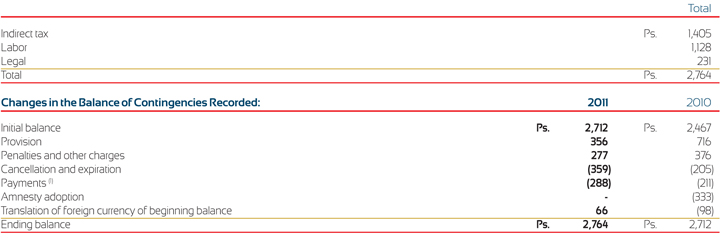

c) Contingencies Recorded in the Balance Sheet:

The Company has various loss contingencies, and reserves have been recorded in those cases where the Company believes an unfavorable resolution is probable. Most of these loss contingencies were recorded as a result of recent business acquisitions. The following table presents the nature and amount of the loss contingencies recorded as of December 31, 2011:

(1) Include Ps. 113 reclassified to other current liabilities.

d) Unsettled Lawsuits:

The Company has entered into legal proceedings with its labor unions, tax authorities and other parties that primarily involve Coca-Cola FEMSA. These proceedings have resulted in the ordinary course of business and are common to the industry in which the Company operates. The aggregate amount being claimed against the Company resulting from such proceedings as of December 31, 2011 is Ps. 6,781. Such contingencies were classified by legal counsel as less than probable but more than remote of being settled against the Company. However, the Company believes that the ultimate resolution of such legal proceedings will not have a material effect on its consolidated financial position or result of operations.

In recent years in its Mexican, Costa Rican and Brazilian territories, Coca-Cola FEMSA has been requested to present certain information regarding possible monopolistic practices. These requests are commonly generated in the ordinary course of business in the soft drink industry where this subsidiary operates. The Company does not expect any significant liability to arise from these contingencies.

e) Collateralized Contingencies:

As is customary in Brazil, the Company has been requested by the tax authorities to collateralize tax contingencies currently in litigation amounting to Ps. 2,418 by pledging fixed assets and entering into available lines of credit which cover such contingencies.

f) Commitments:

As of December 31, 2011, the Company has contractual commitments for finance leases for machinery and transport equipment (see Note 17) and operating lease for the rental of production machinery and equipment, distribution equipment, computer equipment and land for FEMSA Comercio's operations.

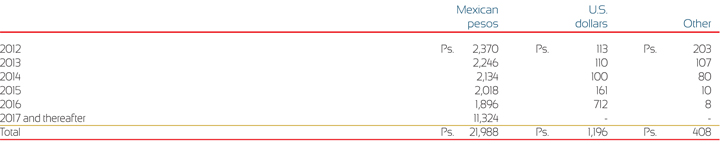

The contractual maturities of the operating lease commitments by currency, expressed in Mexican pesos as of December 31, 2011, are as follows:

Rental expense charged to operations amounted to approximately Ps. 3,249 Ps. 2,602 and Ps. 2,255 for the years ended December 31, 2011, 2010 and 2009, respectively.