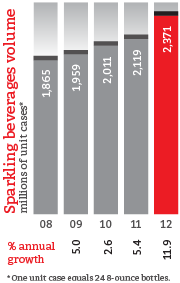

In 2012, we generated solid organic growth. Excluding the results from our recently merged franchise territories of Grupo Tampico, Grupo CIMSA, and Grupo Fomento Queretano, our revenues and income from operations rose 11.6% and 13.3%, respectively. The main drivers of our positive performance for the year were our ability to leverage our new commercial model to capture our industry's value opportunities through our point-of-sale execution, revenue management, and the strength of our multi-category beverage portfolio.

In 2012, we generated solid organic growth. Excluding the results from our recently merged franchise territories of Grupo Tampico, Grupo CIMSA, and Grupo Fomento Queretano, our revenues and income from operations rose 11.6% and 13.3%, respectively. The main drivers of our positive performance for the year were our ability to leverage our new commercial model to capture our industry's value opportunities through our point-of-sale execution, revenue management, and the strength of our multi-category beverage portfolio.

On top of our business' organic growth, we built on our rich history of successful value-creating transactions with our partner, The Coca-Cola Company. In January 2013, we closed the acquisition of 51% of Coca-Cola Bottlers Philippines, Inc. (CCBPI), The Coca-Cola Company's bottling operations in the Philippines. The first incursion of a Latin American bottler outside of the region, this transaction represents an important strategic expansion of our company's bottling footprint beyond Latin America—reinforcing our exposure to fast growing economies and our commitment to the Coca-Cola system.

The Philippines provides a unique opportunity to operate in a country with very attractive economic growth prospects, a private consumption driven economy, an attractive socio-economic and demographic profile, and a cultural and structural resemblance to our Latin American territories. In fact, while the Philippines features one of the highest per capita consumption rates of Coca-Cola products in Southeast Asia, when compared with the per capita consumption of our products in Latin America, the market offers significant opportunities for further growth.

The Philippines also plays to our company's strengths. The country's fast-growing non-alcoholic beverage industry and complex retail landscape will enable us to leverage our proven know-how and operating capabilities to generate revenue growth opportunities and important operating efficiencies. From our world-class point-of-sale execution to our value-driven commercial model, to our continuous investment in our most important asset—our people—we are prepared to take on the challenges and capture the opportunities that we anticipate in this exciting new venture.

proven know-how and operating capabilities to generate revenue growth opportunities and important operating efficiencies. From our world-class point-of-sale execution to our value-driven commercial model, to our continuous investment in our most important asset—our people—we are prepared to take on the challenges and capture the opportunities that we anticipate in this exciting new venture.

Nevertheless, as we take the first steps to build a long-term emerging-market footprint, we remain focused on the opportunities that Latin America presents according to our well-defined strategic framework for growth. With this in mind, in January 2013, we reached an agreement with Grupo Yoli to merge our bottling operations. Once again, we join forces with one of the oldest and most respected family-owned Coca-Cola bottlers in Mexico, with whom we share an aligned entrepreneurial vision and values. Together, we will capitalize on the geographic proximity of our contiguous territories, the mutual benefit of our shared best practices, and the broad consumer appeal of our integrated multi-category portfolio of beverages to create value for all of our stakeholders.

Furthermore, through Jugos del Valle, our joint venture with The Coca-Cola Company and the rest of the bottling system in Mexico, we recently incorporated Santa Clara, a relevant player in the milk, ice cream, and value-added dairy categories. This transaction will enable us to employ the knowledge that we have acquired from Estrella Azul in Panama to continue building on the strong brand equity of Santa Clara in Mexico, while broadening our still beverage portfolio to complement our consumers' healthy lifestyles.